Why Finfluencers Are Winning Gen Z’s Trust in Finance

- Admin

- Sep 11, 2025

- 5 min read

Finfluencers are reshaping Gen Z’s view on money. Discover why they trust finance influencers over banks—and how it’s redefining financial education.

From Instagram reels to TikTok explainers, Finfluencers – also known as finance influencers, are now Gen Z’s go-to guides for budgeting, investing, and financial literacy. What makes them so trusted?

Why Finfluencers Are Winning Gen Z’s Trust in Finance

Introduction

Gen Z is rewriting the financial playbook—and they’re not doing it with traditional advisors, formal suits, or corporate jargon. Instead, they’re turning to Finfluencers: social media creators who break down budgeting, investing, debt, and money tips in bite-sized, relatable content.

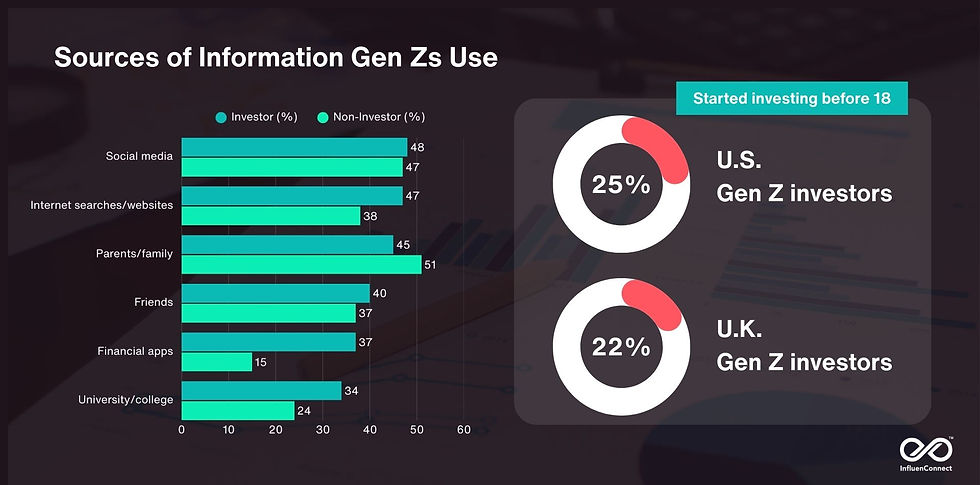

With nearly 48% of Gen Z now relying on social media for financial advice, the rise of the Finfluencer – or finance influencer, isn’t just a passing trend. It’s a seismic shift in how financial literacy is taught, consumed, and trusted.

But why is this generation turning away from banks and turning towards creators on TikTok, YouTube, and Instagram? And what does this mean for the future of financial education, brand partnerships, and trust?

Let’s break down why Finfluencers are winning Gen Z’s trust—and what brands and creators can learn from this movement.

Understanding the Rise of Finfluencers

Finfluencers are not just content creators – they are financial influencers, educators, digital storytellers, and trust-builders. They speak Gen Z’s language, share relatable personal finance experiences, and often demystify complex concepts that traditional institutions struggle to communicate.

What Exactly is a Finfluencer?

A Finfluencer (finance influencer) is someone who shares financial content on social media. Their topics range from basic budgeting to complex investing strategies, but the key is their tone: approachable, transparent, and community-focused.

Unlike financial institutions, which often use formal language and complicated jargon, Finfluencers:

Use real-life stories instead of hypothetical scenarios.

Break down topics like “how to save your first £1,000” or “understanding your credit score” in under 60 seconds.

Build trust by sharing their own wins and mistakes.

This transparency is precisely why Gen Z is listening.

“I don’t want a banker telling me what to do with my money. I want someone who’s been broke and figured it out.” — User quote.

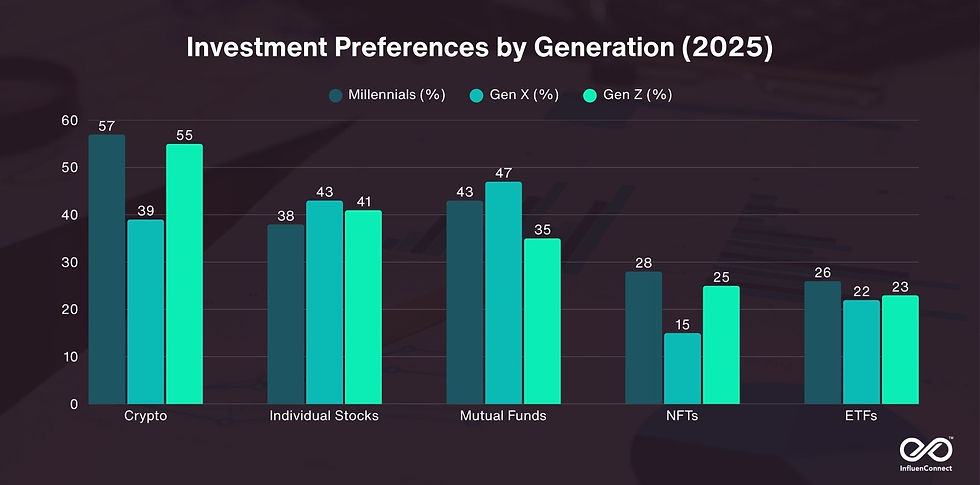

The Stats Behind Gen Z’s Trust in Finfluencers

The data supports the movement:

48% of Gen Z non investors use social media as their primary source of financial information.

Only 32% trust traditional financial advisors, and less than 25% believe banks have their best interests at heart.

Among Gen Z TikTok users, #PersonalFinance videos has succeeded 1.1M post

This shows a clear shift in trust from institutions to individuals.

Why Gen Z Trusts Finfluencers Over Banks

Trust is earned—not inherited. Gen Z didn’t grow up in the era of “just trust your bank.” They came of age during financial instability, rising student debt, and increasing living costs. So naturally, they value authentic, peer-led advice.

But what makes Finfluencers more trustworthy than institutions?

They’re More Relatable Than Bankers

Banks and institutions often speak in stiff, formal tones. Finfluencers don’t. They use:

Humour (e.g., memes about debt)

Visuals (e.g., budgeting spreadsheets shown on camera)

Real talk (“This is how I messed up my first investment”)

This relatability builds emotional connection, which is a key factor in trust-building for Gen Z.

Community Over Corporations

Finfluencers create a sense of community, encouraging questions and dialogue. Their comment sections often feel like forums—safe spaces where Gen Z can discuss topics like:

“How do I start investing with just £100?”

“Is it worth paying off my student loan early?”

“How do I build credit without a credit card?”

Compare that to a static bank website with a chatbot and pages of unread terms and conditions.

Bite-Sized Financial Literacy Wins

Attention spans are shrinking, but Finfluencers adapt. They simplify financial education into quick, snackable formats:

60-second TikToks on how compound interest works

Instagram carousels comparing debit vs. credit cards

YouTube shorts explaining student loan repayments

This makes financial literacy accessible - and binge-worthy.

The Risks, Realities, and Brand Opportunities

While Finfluencers offer value, the movement isn’t without its risks. But for brands—especially in fintech, banking, and investment platforms—the opportunity is massive.

Let’s unpack the good, the bad, and the strategic.

Are Finfluencers (Finance Influencer) Regulated?

Not every Finfluencer or finance influencer is licensed, which raises legitimate concerns. According to a 2024 report by the California Department of Financial Protection and Innovation (DFPI), 35% of finance-related content on social media contains misleading or unverified advice.

Some influencers push affiliate links, crypto investments, or trading platforms without clear disclosure, potentially misleading their followers.

To combat this:

The UK’s Financial Conduct Authority (FCA) released updated guidelines in early 2025, requiring stricter ad disclosures and disclaimers from financial content creators.

Platforms like TikTok and Instagram are working on financial literacy labels – similar to health disclaimers on nutrition advice.

Still, the burden of due diligence ultimately falls on both users and brands to verify the credibility of every finance influencer they engage with.

How Fintech Brands Are Collaborating Responsibly With Finance Influencers

Brands are not sitting idle. Many are launching collaborations with vetted Finfluencers to offer transparent, educational content. For example:

PayPal: Adapting to the Influencer Era

A fintech veteran, PayPal has embraced influencer marketing to expand its reach, using creators to humanise its message and stay relevant with younger audiences.

Origin x Mrs. Dow Jones

Origin teamed up with finance influencer Haley Sacks (aka Mrs. Dow Jones) to simplify money management through humour and relatable content—driving awareness among young professionals.

Klarna x The Broke Black Girl

Klarna partnered with Dasha Kennedy to promote financial advocacy. Her real-talk approach helped Klarna build trust and connect with women of colour on budgeting and debt.

These partnerships work because they blend trust, authenticity, and clear messaging – without the stiff corporate wrapper.

What Should Brands and Creators Prioritise?

For brands wanting to tap into this trend:

For creators:

Consider FCA’s new guidance and disclose any paid partnerships or financial affiliations clearly.

Focus on storytelling and audience value, not just trends.

Stay updated with financial news and collaborate with certified professionals where possible.

Summary

The rise of Finfluencers is more than a social media trend—it’s a redefinition of financial literacy, education, and trust. Gen Z, shaped by uncertainty and economic challenges, is looking for authentic, relatable, and transparent voices to guide their financial journey.

Finfluencers have stepped up to fill this role—not as replacements for financial advisors, but as digital bridges that make finance feel less intimidating and more accessible.

For brands, this is a massive opportunity to build trust and relevance. For creators, it’s a chance to inspire a generation to take control of their financial future.

Ready to Take the Next Step?

At InfluenConnect™, we are paving the way for the next generation of influencers by breaking down language barriers, making it easier for you to collaborate globally. InfluenConnect™ focuses on diversity, global reach, data-driven insights, and sustainability. Contact us today to explore how we can help you expand your global presence!

Comments